Q3 2022 BOAST Report

Q3 2022 BOAST Report

Cannabis Beverages

Welcome to the 3rd edition of the BOAST report on Cannabis Beverages.

The intent of this document is to allow interested parties access to data surrounding Cannabis Beverages as it relates to growth of brands, and the category of Cannabis Beverages overall.

There have been many predictions recently that state the category is poised for extreme growth over the next 5 to 10 years. Even in the face of a recession and downturn in cannabis sales, the Cannabis Beverage category is fortunate to have seen growth in sales this past quarter.

I am excited that we now have data for Massachusetts to add to the report. For the purpose of this report, I will be including data pulled from Headset Data for the states of Washington, Oregon, California, Nevada, Colorado, Michigan and Massachusetts. This represents all the data I have access to so if you have additional data for other states and would like in included in the Q4 report please let me know. (If you are interested in my previous two quarterly 2022 reports, they will be included at the end of this document.)

The “High vs Low Dose” Argument:

I have been hearing differing views about what the future of Cannabis Beverages will look like. Will high dose or low dose come out on top when this category normalizes? Tensions are brewing and people are aligning and taking sides, generating arguments for their given brand or perspective. There have been questions that have come up recently in some articles, stating that there is growing concern surrounding high-dose drink safety.

I’d like to remind readers that high-dose drinks are not intended to be consumed in one serving. There are clearly defined rules about dosing beverages and in most states, the legal dose is 10 mg. Consumers simply get more doses of cannabis in a higher mg package. Pushing regulators to review the dosing of beverages is a slippery slope and leaves the industry wondering what will happen next with things like vape pens, dabs, and infused joints. For what it’s worth, I offer my perspective.

I researched alcohol’s top brands in the USA, and it is interesting what the top two brands are. In the USA, the top alcohol brand is Anheuser-Busch. They are a beer producer, and for the sake of argument we will call this “low dose”. The number two alcohol brand in the USA is Jack Daniel’s. We will call this the “high dose”. These companies are both highly successful and have massive market share. Beer is a single serving, much like a 2-10 mg Cannabis Beverage, and Jack Daniel’s is packaged in a bottle that will have multiple servings, just like a high-dose bottle of Cannabis Beverages. It is also not advised to drink an entire bottle of Jack Daniels. Both companies have a continued loyal fan base. There are also many great Cannabis Beverage brands out there doing big things. I enjoy sipping on a low-dose cannabis beverage AND I like taking a serving of a high-dose drink. They both give me the desired effect.

I have much respect for all the great pioneers of the category. I believe what matters most is creating the best-tasting, highest-quality Cannabis Beverages possible. This will grow the consumer base and over time, we will all enjoy the growth of the industry.

What is selling in the USA:

In this table, we see that 100 mg Cannabis Beverages make up 50% of the total market share. This is many consumers saying ‘price per milligram’ matters. They get 10 to 20 servings in a bottle for a price that works best for their budget.

| MG of THC | Total Sales | Total Units | % of Total Sales | % of Total Units |

| 100mg THC | $68,903,866 | 6,396,261 | 49.4% | 50.7% |

| 0mg-5mg THC | $11,874,095 | 1,781,183 | 8.5% | 14.1% |

| 1000mg THC | $11,231,345 | 315,672 | 8.1% | 2.5% |

| 10mg THC | $9,368,863 | 1,694,553 | 6.7% | 13.4% |

| 20mg THC | $7,128,324 | 400,963 | 5.1% | 3.2% |

In Massachusetts, the maximum is 5 mg per Cannabis Beverage, and when they are taken out of the data pool, around 55% of sales and 57% of units sold go to 100 mg drinks. The important takeaway from the table below is that there is room for all potency in the category. I do believe the Cannabis Beverage industry will see trends that mirror alcohol over time. The number one factor that limits this today is the cost of low-dose drinks compared to high-dose drinks. For low-dose drinks to get more market share the price needs to come down and it’s hard with our current regulations.

Market Share of Cannabis Beverages in Each State, Units Sold and Revenue

| State | % of State Market Share | Units Sold | Revenue |

| CA | 1.40% | 1,400,000 | $17,600,000.00 |

| WA | 3.00% | 1,200,000 | $9,500,000.00 |

| MA | 1.40% | 585,200 | $5,300,000.00 |

| CO | 1.20% | 422,400 | $4,600,000.00 |

| OR | 1.70% | 304,600 | $4,200,000.00 |

| MI | 0.50% | 341,800 | $2,900,000.00 |

| NV | 1.00% | 210,700 | $2,100,000.00 |

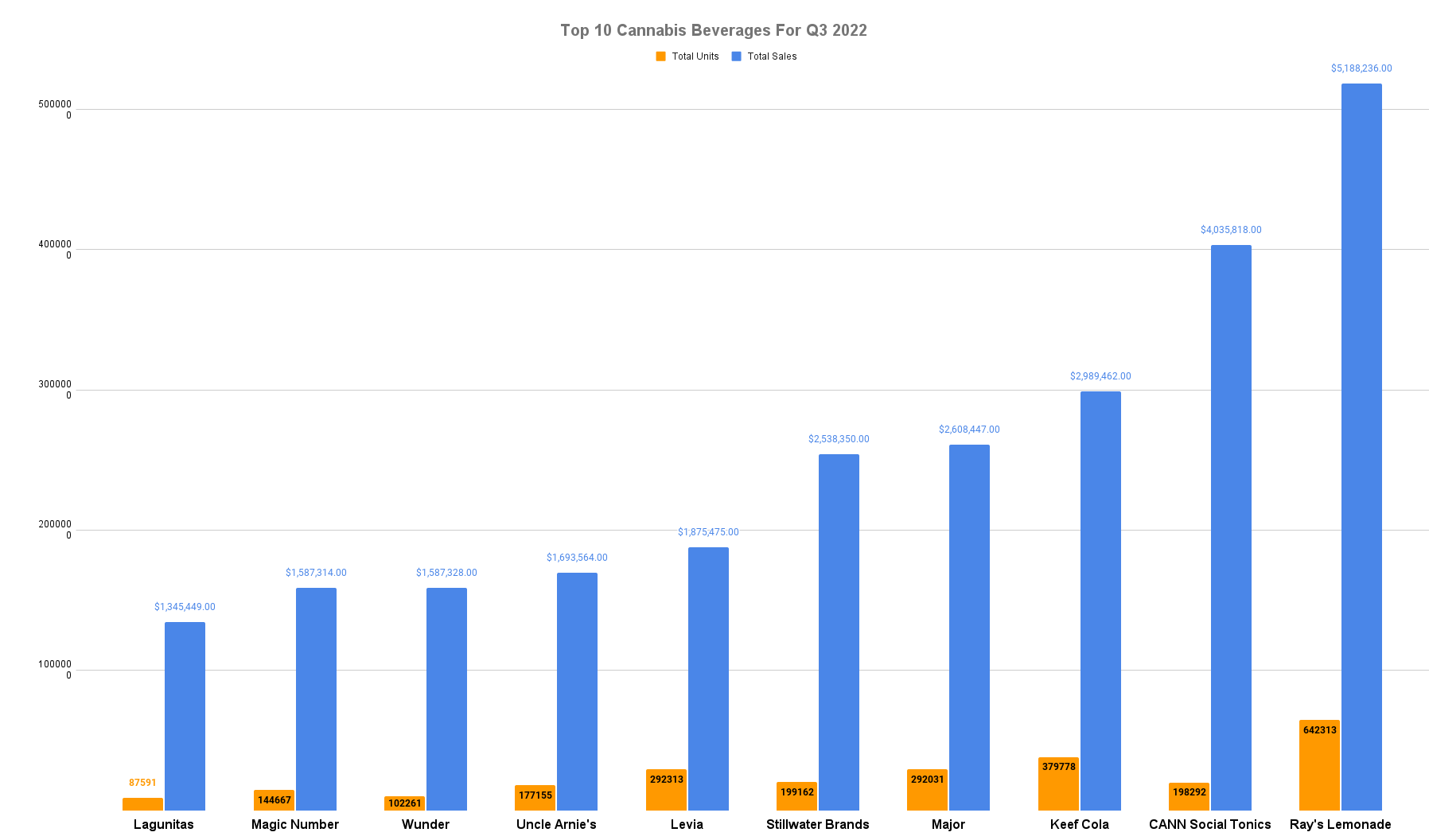

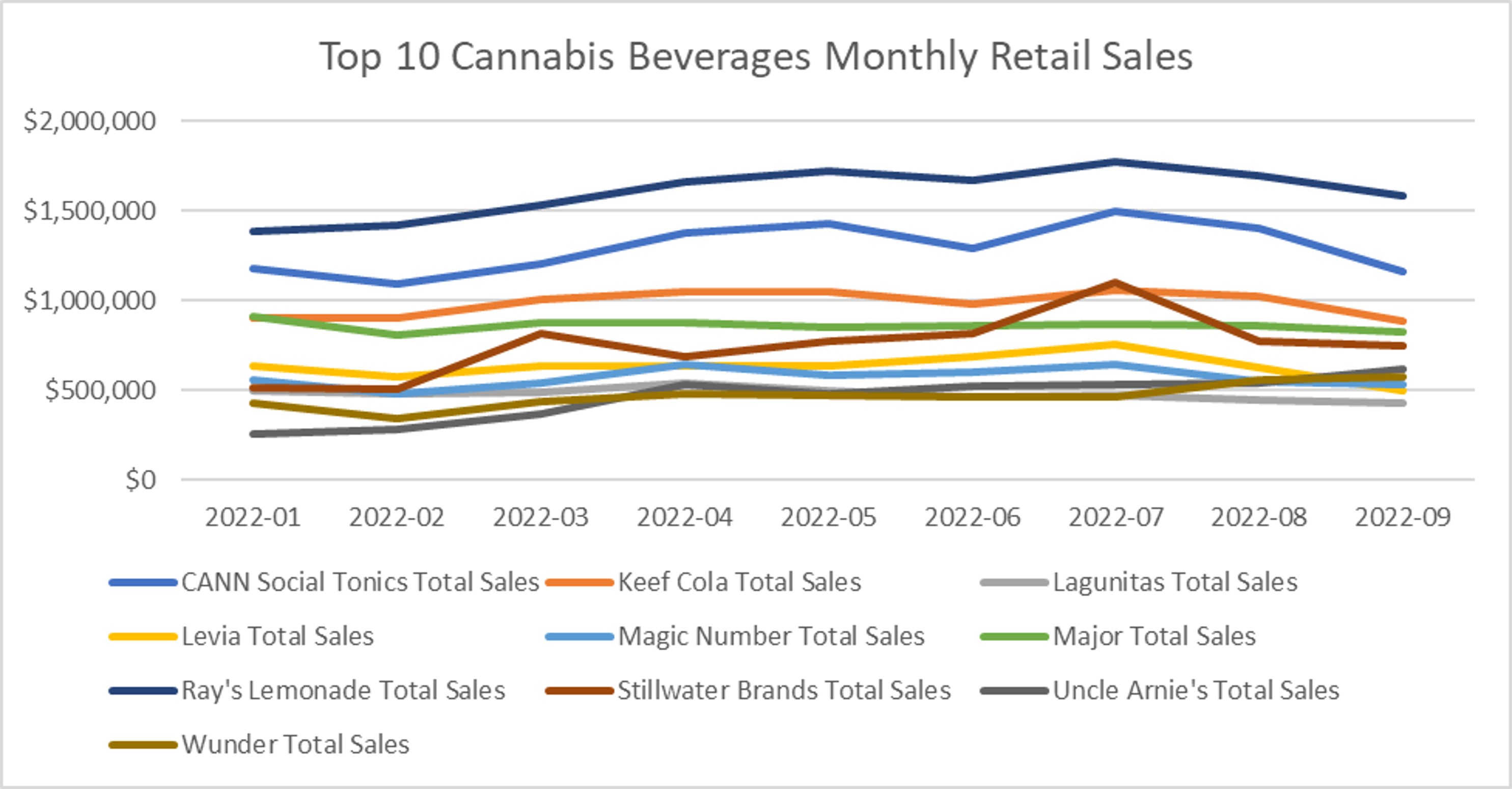

Top Performing Cannabis Beverages Brands for Q3 2022:

There has not been any significant movement in the ranks of the top 10 Cannabis Beverage Brands. Keef Cola and Cann Social Tonics have exchanged spots in the top 10 and Levia is doing big things in a 5mg market! One big factor with these brands will be if they are expanding to other markets soon. Another factor that the graph does not take into consideration is profitability.

Top 10 Cannabis Beverages Growth Though Q1-Q3 2022

| Brand Name | Total Sales Current | Growth | # of products |

| Ray’s Lemonade | $14,448,733 | 87.6% | 47 |

| CANN Social Tonics | $11,633,715 | 19.4% | 52 |

| Keef Cola | $8,859,316 | -10.7% | 87 |

| Major | $7,756,920 | -32.9% | 18 |

| Stillwater Brands | $6,738,639 | 13.7% | 33 |

| Levia | $5,682,773 | 13.2% | 15 |

| Magic Number | $5,127,622 | -1.1% | 75 |

| Lagunitas | $4,316,144 | -20.2% | 21 |

| Wunder | $4,222,813 | 236.3% | 24 |

| Uncle Arnie’s | $4,137,645 | 108.3% | 9 |

Market Share of Cannabis Beverages in Each State, Units Sold and Revenue

| State | % of State Market Share | Units Sold | Revenue |

| CA | 1.40% | 1,400,000 | $17,600,000.00 |

| WA | 3.00% | 1,200,000 | $9,500,000.00 |

| MA | 1.40% | 585,200 | $5,300,000.00 |

| CO | 1.20% | 422,400 | $4,600,000.00 |

| OR | 1.70% | 304,600 | $4,200,000.00 |

| MI | 0.50% | 341,800 | $2,900,000.00 |

| NV | 1.00% | 210,700 | $2,100,000.00 |

Washington Top 10:

Currently in Washington, the Cannabis Beverage Category is ranked #6. The market share of the total cannabis market in Washington is 3.0%. 1.2 million units were sold within the state for $9.5 million dollars. Congrats to Agro Couture and Loaded Soda for moving up the Ranks in Washington! The top 10 Cannabis Beverage companies within Washington are as follows:

| Brand Name | Total Sales | Total Units | % of Total Sales | % of Total Units | ||

| 1 | Ray’s Lemonade | $5,188,236 | 642,313 | 54.5% | 55.3% | |

| 2 | Major | $2,181,959 | 246,132 | 22.9% | 21.2% | |

| 3 | Green Revolution | $795,390 | 112,656 | 8.3% | 9.7% | |

| 4 | Sinners & Saints | $275,421 | 37,575 | 2.9% | 3.2% | |

| 5 | Agro Couture | $261,486 | 40,202 | 2.7% | 3.5% | |

| 6 | Happy Apple | $221,944 | 13,759 | 2.3% | 1.2% | |

| 7 | Blaze Soda | $203,342 | 22,772 | 2.1% | 2.0% | |

| 8 | Fractal Infused | $142,939 | 16,404 | 1.5% | 1.4% | |

| 9 | Loaded Soda | $59,228 | 6,377 | 0.6% | 0.5% | |

| 10 | Passion Flower Cannabis | $50,080 | 6,007 | 0.5% | 0.5% | |

California Top 10:

Currently in California, the Cannabis Beverage Category is ranked #7. The market share of the total cannabis market in California is 1.4%. 1.4 million units were sold within the state for $17.6 million dollars. Big shout out to Lagunitas, Wunder, and Cannavis Syrup for moving up the ranks this Quarter! The top 10 Cannabis Beverage companies within California are as follows:

| Brand Name | Total Sales | Total Units | % of Total Sales | % of Total Units | |

| 1 | CANN Social Tonics | $2,382,126 | 117,991 | 13.6% | 8.7% |

| 2 | Uncle Arnie’s | $1,693,564 | 177,155 | 9.6% | 13.0% |

| 3 | Wunder | $1,587,328 | 102,261 | 9.0% | 7.5% |

| 4 | Lagunitas | $1,344,068 | 87,353 | 7.6% | 6.4% |

| 5 | Keef Cola | $1,313,104 | 147,163 | 7.5% | 10.8% |

| 6 | Tonik | $894,940 | 88,968 | 5.1% | 6.5% |

| 7 | Habit | $781,258 | 32,438 | 4.4% | 2.4% |

| 8 | Cannavis Syrup | $708,056 | 20,425 | 4.0% | 1.5% |

| 9 | CQ (Cannabis Quencher) | $693,332 | 55,731 | 3.9% | 4.1% |

| 10 | Pabst Labs | $669,780 | 76,784 | 3.8% | 5.6% |

Oregon Top 10:

Currently in Oregon, the Cannabis Beverage Category is ranked #6. The market share of the total cannabis market in Oregon is 1.7%. 340,600 units were sold within the state for $4.2 million dollars. Congrats to Herban Tribe and Slurp for moving up the top 10 ranks in Oregon. The top 10 Cannabis Beverage companies within Oregon are as follows:

| Brand Name | Total Sales | Total Units | % of Total Sales | % of Total Units | |

| 1 | Magic Number | $1,587,314 | 144,667 | 38.1% | 47.5% |

| 2 | Mule Extracts | $508,598 | 20,235 | 12.2% | 6.6% |

| 3 | Hapy Kitchen | $464,531 | 34,627 | 11.1% | 11.4% |

| 4 | Major | $306,696 | 35,047 | 7.4% | 11.5% |

| 5 | Crown B Alchemy | $260,915 | 9,996 | 6.3% | 3.3% |

| 6 | Mellow Vibes | $165,863 | 5,894 | 4.0% | 1.9% |

| 7 | Herban Tribe | $145,738 | 8,608 | 3.5% | 2.8% |

| 8 | Hush | $133,880 | 7,404 | 3.2% | 2.4% |

| 9 | Private Stash | $109,999 | 11,039 | 2.6% | 3.6% |

| 10 | Slurp | $60,481 | 2,605 | 1.5% | 0.9% |

Colorado top 10:

Currently in Colorado, the Cannabis Beverage Category is ranked #8. The market share of the total cannabis market in Colorado is 1.2%. 422,400 units were sold within the state for $4.6 million dollars. Congrats to Dialed in Gummies, ebb, and Major for moving up the top 10 list in Colorado. The top 10 Cannabis Beverage companies within Colorado are as follows:

| Brand Name | Total Sales | Total Units | % of Total Sales | % of Total Units | |

| 1 | Keef Cola | $1,676,284 | 232,605 | 36.4% | 55.1% |

| 2 | Stillwater Brands | $1,638,633 | 99,258 | 35.6% | 23.5% |

| 3 | Dixie Elixirs | $354,031 | 22,666 | 7.7% | 5.4% |

| 4 | Dialed In Gummies | $270,357 | 11,768 | 5.9% | 2.8% |

| 5 | CannaPunch | $184,634 | 10,191 | 4.0% | 2.4% |

| 6 | ebb. | $84,568 | 5,239 | 1.8% | 1.2% |

| 7 | Oh Hi | $77,928 | 12,834 | 1.7% | 3.0% |

| 8 | marQaha | $76,416 | 6,797 | 1.7% | 1.6% |

| 9 | Bosky Labs | $74,132 | 3,974 | 1.6% | 0.9% |

| 10 | Major | $45,898 | 3,619 | 1.0% | 0.9% |

Nevada top 10:

Currently in Nevada, the Cannabis Beverage Category is ranked #6. The market share of the total cannabis market in Nevada is 1.0%. 210,700 units were sold within the state for $2.1 million dollars. Congrats to HaHa, and Sips for moving up the top 10 list in Nevada. The top 10 Cannabis Beverage companies within Nevada are as follows:

| Brand Name | Total Sales | Total Units | % of Total Sales | % of Total Units | |

| 1 | Sip | $777,231 | 85,826 | 36.2% | 40.7% |

| 2 | CANN Social Tonics | $352,329 | 22,996 | 16.4% | 10.9% |

| 3 | HaHa | $182,586 | 32,992 | 8.5% | 15.7% |

| 4 | Sips | $169,817 | 18,807 | 7.9% | 8.9% |

| 5 | Select | $152,679 | 6,768 | 7.1% | 3.2% |

| 6 | CannaPunch | $133,002 | 7,695 | 6.2% | 3.7% |

| 7 | Cannalean | $116,994 | 8,685 | 5.4% | 4.1% |

| 8 | PRO Canna | $79,291 | 7,347 | 3.7% | 3.5% |

| 9 | Mellow Vibes | $59,859 | 6,380 | 2.8% | 3.0% |

| 10 | Canna Hemp | $41,263 | 786 | 1.9% | 0.4% |

Michigan to 10:

Currently in Michigan, the Cannabis Beverage Category is ranked #7. The market share of the total cannabis market in Michigan is 0.5%. 341,800 units were sold within the state for $2.9 million dollars. Congrats to Chill Medicated, Dixie Elixirs, Select, Detroit Edibles/Detroit Fudge, MKX Oil Company, and CYP for climbing the top 10 list in Michigan. The top 10 Cannabis Beverage companies within Michigan are as follows:

| Brand Name | Total Sales | Total Units | % of Total Sales | % of Total Units | |

| 1 | Stillwater Brands | $899,717 | 99,904 | 30.8% | 29.2% |

| 2 | Chill Medicated | $385,754 | 21,109 | 13.2% | 6.2% |

| 3 | Dixie Elixirs | $353,845 | 19,190 | 12.1% | 5.6% |

| 4 | Select | $308,795 | 17,557 | 10.6% | 5.1% |

| 5 | Wynk | $270,661 | 116,946 | 9.3% | 34.2% |

| 6 | Northern Connections | $229,300 | 12,737 | 7.8% | 3.7% |

| 7 | Detroit Edibles / Detroit Fudge Company | $152,918 | 9,361 | 5.2% | 2.7% |

| 8 | MKX Oil Company | $100,350 | 16,601 | 3.4% | 4.9% |

| 9 | Tonic | $97,722 | 6,562 | 3.3% | 1.9% |

| 10 | CYP | $58,538 | 16,985 | 2.0% | 5.0% |

Massachusetts top 10:

Currently in Massachusetts, the Cannabis Beverage Category is ranked #7. The market share of the total cannabis market in Massachusetts is 1.4%. 585,200 units were sold within the state for $5.3 million dollars. Congrats to all of the top 10 in the state. This is the first data I have pulled for the state and will be fun to watch what happens in a low-dose state. The top 10 Cannabis Beverage companies within Massachusetts are as follows:

| Brand Name | Total Sales | Total Units | % of Total Sales | % of Total Units | |

| 1 | Levia | $1,875,475 | 292,313 | 35.2% | 50.0% |

| 2 | CANN Social Tonics | $1,301,363 | 57,305 | 24.4% | 9.8% |

| 3 | Hi5 Seltzer | $796,676 | 62,802 | 15.0% | 10.7% |

| 4 | Cantrip | $489,005 | 88,046 | 9.2% | 15.0% |

| 5 | Vibations: High + Energy | $278,852 | 14,013 | 5.2% | 2.4% |

| 6 | House Brand | $153,322 | 15,851 | 2.9% | 2.7% |

| 7 | Select | $145,630 | 5,289 | 2.7% | 0.9% |

| 8 | Endless Coast | $85,189 | 21,235 | 1.6% | 3.6% |

| 9 | Wynk | $80,997 | 11,876 | 1.5% | 2.0% |

| 10 | Sip | $50,725 | 6,850 | 1.0% | 1.2% |