THE BOAST REPORT – Q2 Report 2022

Q2 Boast Report on Cannabis Beverages

Welcome to the 2nd edition of the BOAST report on Cannabis Beverages within the cannabis industry. In this edition, I will give you the highlights for the 2nd quarter of 2022. I report on the data I pull from Headset Data on the states I have data for, as it relates to the Cannabis Beverage industry in the USA. I currently have data for Washington, Oregon, California, Nevada, Colorado and Michigan. For most of the information contained in this report, the date range is from 1 April 2022 to 30 June 2022.

If you did not see my first report, there is a link to the report below and a description of why I am producing this report. If you have data for any other state that you would like to have me add to this report, please let me know.

Q1 2022 BOAST Report: If you would like to see a previous BOAST report click this link.

What changed at a glance: We are growing in a space where other categories are losing ground! There are many things to be excited about in the Cannabis Beverage Industry! New brands are hitting store shelves each month and consumer acceptance is leading to increased market share over the past quarter. The industry has realized a larger market share over other segments, growing from a market share of 1.2% total market share in Q1 to 1.4% market share in Q2. This is very exciting growth!

- 14% Growth in Beverage Market Share

- 12.1% Growth in Revenue

- 16.7% Growth in Units Sold

Congratulations to all the companies in the category! You are all making a difference that is showing up in real numbers in our little slice of the “cannabis market” pie. Cheers to the visionaries and the true pioneers of this great segment within our industry and to the wonderful budtenders, who help ensure our products make it into the hands of thirsty customers!

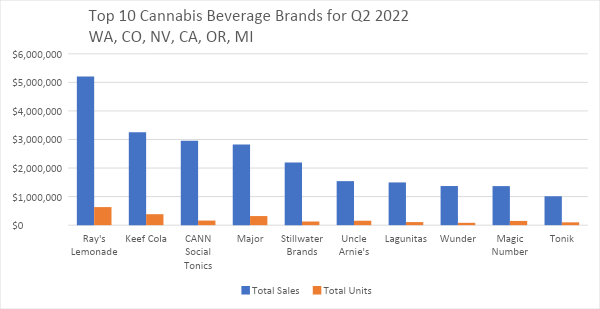

Top Performing Cannabis Beverage Brands for Q2 of 2022: Congratulations to Uncle Arnie’s for climbing 2 spots and both Keef Cola and CANN Social Tonics for climbing a spot this quarter in top 10 ranking. Great work and job well done to you and your teams.

| Q2 2022 | Q1 2022 | Change | % of | % of | Rank | |||

| Brand Name | Total Sales | Total Units | Total Sales | Total Units | from Q1 | Total Sales | Total Units | Change |

| Ray’s Lemonade | $5,205,673 | 632,348 | $4,737,986 | 564,125 | 10.00% | 12.9% | 17.6% | 0 |

| Keef Cola | $3,255,480 | 383,656 | $2,939,387 | 344,376 | -10.00% | 8.0% | 10.7% | 1 |

| CANN Social Tonics | $2,955,023 | 160,493 | $2,763,930 | 151,409 | -6.50% | 7.3% | 4.5% | 1 |

| Major | $2,825,404 | 318,193 | $3,013,529 | 341,312 | -6.30% | 7.0% | 8.9% | -2 |

| Stillwater Brands | $2,197,364 | 127,952 | $1,687,004 | 90,662 | 30.00% | 5.4% | 3.6% | 0 |

| Uncle Arnie’s | $1,541,248 | 155,432 | $975,226 | 93,114 | 58.00% | 3.8% | 4.3% | 2 |

| Lagunitas | $1,496,167 | 107,380 | $1,473,260 | 102,272 | 1.50% | 3.7% | 3.0% | -1 |

| Wunder | $1,369,888 | 81,843 | $1,127,701 | 82,418 | 21.00% | 3.4% | 2.3% | -1 |

| Magic Number | $1,367,390 | 147,992 | $968,900 | 18,517 | 41.00% | 3.4% | 4.1% | 0 |

| Tonik | $1,011,886 | 98,824 | $779,317 | 76,641 | 29.00% | 2.5% | 2.7% | 0 |

Top 10 Company Growth for WA, OR, CA, NV, CO and MI

| Brand Name | Total Sales Current | Growth | # of categories | # of products | ||||

| Ray’s Lemonade | $5,205,673 | 126.8% | 1 | 46 | ||||

| Keef Cola | $3,255,480 | -7.4% | 1 | 87 | ||||

| CANN Social Tonics | $2,955,023 | -8.3% | 1 | 48 | ||||

| Major | $2,825,404 | -36.3% | 1 | 17 | ||||

| Stillwater Brands | $2,197,364 | 14.6% | 1 | 32 | ||||

| Uncle Arnie’s | $1,541,248 | 136.4% | 1 | 5 | ||||

| Lagunitas | $1,496,167 | -22.2% | 1 | 17 | ||||

| Wunder | $1,369,888 | 184.9% | 1 | 21 | ||||

| Magic Number | $1,367,390 | 23.1% | 1 | 40 | ||||

| Tonik | $1,011,886 | 54.2% | 1 | 53 | ||||

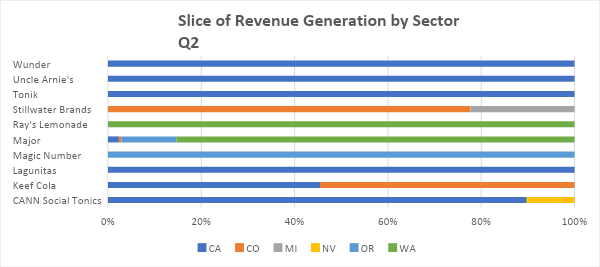

State by State Breakdown Q2 2022

| State | % of State Market Share | Units Sold | Revenue |

| WA | 3.00% | 1,200,000 | $9,700,000.00 |

| CO | 1.20% | 384,700 | $4,500,000.00 |

| CA | 1.40% | 1,400,000 | $18,000,000.00 |

| OR | 1.70% | 326,900 | $4,200,000.00 |

| NV | 1.00% | 174,400 | $1,900,000.00 |

| MI | 0.40% | 192,500 | $2,100,000.00 |

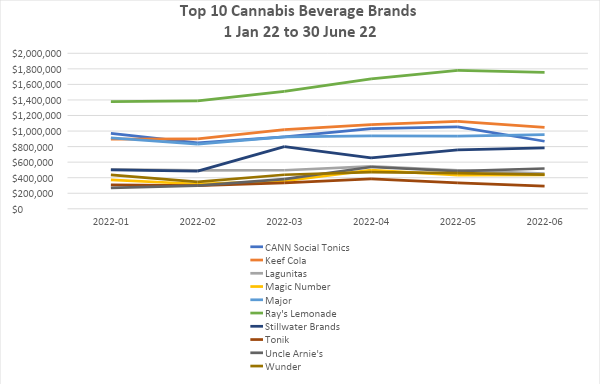

Year to Date Top 10 Brands

| Brand Name | Total Sales | Total Units | % of Total Sales | % of Total Units | |

| 1 | Ray’s Lemonade | $9,482,691 | 1,137,681 | 12.4% | 17.1% |

| 2 | Keef Cola | $6,068,356 | 707,846 | 7.9% | 10.7% |

| 3 | CANN Social Tonics | $5,698,203 | 310,739 | 7.4% | 4.7% |

| 4 | Major | $5,493,869 | 620,804 | 7.2% | 9.4% |

| 5 | Stillwater Brands | $3,982,454 | 222,843 | 5.2% | 3.4% |

| 6 | Lagunitas | $2,991,074 | 210,649 | 3.9% | 3.2% |

| 7 | Wunder | $2,591,205 | 170,668 | 3.4% | 2.6% |

| 8 | Uncle Arnie’s | $2,489,875 | 246,165 | 3.3% | 3.7% |

| 9 | Magic Number | $2,417,043 | 277,817 | 3.2% | 4.2% |

| 10 | Tonik | $1,949,177 | 187,829 | 2.5% | 2.8% |

Washington Top 10: Currently in Washington, the Cannabis Beverage Category is ranked #6. The market share of total cannabis market in Washington is 3.0%. 1.2 million units were sold within the state for $9.7 million dollars. The top 10 Cannabis Beverage companies within Washington are as follows:

| Brand Name | Total Sales | Total Units | % of Total Sales | % of Total Units | |

| 1 | Ray’s Lemonade | $5,240,913 | 636,774 | 53.5% | 54.8% |

| 2 | Major | $2,423,540 | 268,340 | 24.7% | 23.1% |

| 3 | Green Revolution | $801,995 | 107,059 | 8.2% | 9.2% |

| 4 | Sinners & Saints | $290,757 | 38,562 | 3.0% | 3.3% |

| 5 | Happy Apple | $215,078 | 13,345 | 2.2% | 1.1% |

| 6 | Fractal Infused | $201,853 | 22,800 | 2.1% | 2.0% |

| 7 | Blaze Soda | $187,136 | 20,347 | 1.9% | 1.7% |

| 8 | Agro Couture | $157,887 | 22,836 | 1.6% | 2.0% |

| 9 | Passion Flower Cannabis | $63,042 | 9,775 | 0.6% | 0.8% |

| 10 | Legal Beverages | $60,078 | 6,305 | 0.6% | 0.5% |

California Top 10: Currently in California, the Cannabis Beverage Category is ranked #8. The market share of total cannabis market in California is 1.4%. 1.4 million units were sold within the state for $18 million dollars. Big shout out to both Pabst Labs and Cannavis Syrup for making the CA top 10 list. The top 10 Cannabis Beverage companies within California are as follows:

| Brand Name | Total Sales | Total Units | % of Total Sales | % of Total Units | |

| 1 | CANN Social Tonics | $2,655,514 | 143,162 | 14.8% | 10.5% |

| 2 | Uncle Arnie’s | $1,541,306 | 155,446 | 8.6% | 11.4% |

| 3 | Lagunitas | $1,498,467 | 107,533 | 8.3% | 7.9% |

| 4 | Keef Cola | $1,479,961 | 170,876 | 8.2% | 12.6% |

| 5 | Wunder | $1,372,289 | 81,973 | 7.6% | 6.0% |

| 6 | Tonik | $1,011,133 | 98,715 | 5.6% | 7.3% |

| 7 | Manzanita Naturals | $770,533 | 85,939 | 4.3% | 6.3% |

| 8 | CQ (Cannabis Quencher) | $755,823 | 63,688 | 4.2% | 4.7% |

| 9 | Pabst Labs | $678,481 | 69,402 | 3.8% | 5.1% |

| 10 | Cannavis Syrup | $654,868 | 19,910 | 3.6% | 1.5% |

Oregon Top 10: Currently in Oregon, the Cannabis Beverage Category is ranked #8. The market share of total cannabis market in Oregon is 1.7%. 326,900 units were sold within the state for $4.2 million dollars. The top 10 Cannabis Beverage companies within Oregon are as follows:

| Brand Name | Total Sales | Total Units | % of Total Sales | % of Total Units | |

| 1 | Magic Number | $1,370,757 | 148,315 | 32.3% | 45.2% |

| 2 | Mule Extracts | $570,350 | 20,620 | 13.4% | 6.3% |

| 3 | Hapy Kitchen | $425,309 | 31,843 | 10.0% | 9.7% |

| 4 | Major | $333,858 | 43,755 | 7.9% | 13.3% |

| 5 | Crown B Alchemy | $242,482 | 10,058 | 5.7% | 3.1% |

| 6 | Mellow Vibes (formerly Head Trip) | $202,706 | 7,483 | 4.8% | 2.3% |

| 7 | Hush | $152,204 | 6,900 | 3.6% | 2.1% |

| 8 | Private Stash | $148,866 | 14,507 | 3.5% | 4.4% |

| 9 | Herban Tribe | $138,611 | 8,101 | 3.3% | 2.5% |

| 10 | Sips | $135,660 | 4,925 | 3.2% | 1.5% |

Colorado top 10: Currently in Colorado, the Cannabis Beverage Category is ranked #8. The market share of total cannabis market in Colorado is 1.2%. 384,700 units were sold within the state for $4.5 million dollars. The top 10 Cannabis Beverage companies within Colorado are as follows:

| Brand Name | Total Sales | Total Units | % of Total Sales | % of Total Units | |

| 1 | Keef Cola | $1,781,845 | 214,262 | 39.5% | 55.6% |

| 2 | Stillwater Brands | $1,708,254 | 88,359 | 37.9% | 22.9% |

| 3 | Dixie Elixirs | $418,385 | 25,408 | 9.3% | 6.6% |

| 4 | CannaPunch | $191,456 | 10,194 | 4.2% | 2.6% |

| 5 | Oh Hi | $114,702 | 18,606 | 2.5% | 4.8% |

| 6 | marQaha | $96,178 | 8,801 | 2.1% | 2.3% |

| 7 | Bosky Labs | $36,103 | 1,985 | 0.8% | 0.5% |

| 8 | Ceria Brewing Co. | $31,446 | 4,656 | 0.7% | 1.2% |

| 9 | Canyon | $30,113 | 4,871 | 0.7% | 1.3% |

| 10 | ebb. | $28,894 | 1,898 | 0.6% | 0.5% |

Nevada top 10: Currently in Nevada, the Cannabis Beverage Category is ranked #8. The market share of total cannabis market in Nevada is 1.0%. 174,400 units were sold within the state for $1.9 million dollars. The top 10 Cannabis Beverage companies within Nevada are as follows:

| Brand Name | Total Sales | Total Units | % of Total Sales | % of Total Units | |

| 1 | Sips | $563,626 | 63,280 | 29.8% | 36.3% |

| 2 | CANN Social Tonics | $302,877 | 17,477 | 16.0% | 10.0% |

| 3 | Select | $171,200 | 8,322 | 9.0% | 4.8% |

| 4 | CannaPunch | $170,190 | 9,042 | 9.0% | 5.2% |

| 5 | Mellow Vibes (formerly Head Trip) | $152,440 | 18,279 | 8.1% | 10.5% |

| 6 | HaHa | $137,891 | 23,350 | 7.3% | 13.4% |

| 7 | Cannalean | $128,546 | 10,143 | 6.8% | 5.8% |

| 8 | PRO Canna | $94,069 | 8,887 | 5.0% | 5.1% |

| 9 | Canna Hemp | $50,479 | 882 | 2.7% | 0.5% |

| 10 | Sip | $29,532 | 3,364 | 1.6% | 1.9% |

Michigan to 10: Currently in Michigan, the Cannabis Beverage Category is ranked #8. The market share of total cannabis market in Michigan is 0.4%. 192,500 units were sold within the state for $2.1 million dollars. The top 10 Cannabis Beverage companies within Michigan are as follows:

| Brand Name | Total Sales | Total Units | % of Total Sales | % of Total Units | |

| 1 | Chill Medicated | $565,105 | 26,530 | 26.6% | 13.8% |

| 2 | Stillwater Brands | $490,178 | 39,677 | 23.1% | 20.6% |

| 3 | Wynk | $207,303 | 58,165 | 9.8% | 30.2% |

| 4 | Select | $198,364 | 11,615 | 9.3% | 6.0% |

| 5 | Northern Connections | $160,180 | 7,860 | 7.5% | 4.1% |

| 6 | Tonic | $117,097 | 8,369 | 5.5% | 4.3% |

| 7 | Dixie Elixirs | $115,963 | 6,389 | 5.5% | 3.3% |

| 8 | Happi | $92,787 | 5,972 | 4.4% | 3.1% |

| 9 | CYP | $76,658 | 20,004 | 3.6% | 10.4% |

| 10 | High Life Farms | $46,387 | 4,319 | 2.2% | 2.2% |